NRAS Document Samples - Employment

Payslips

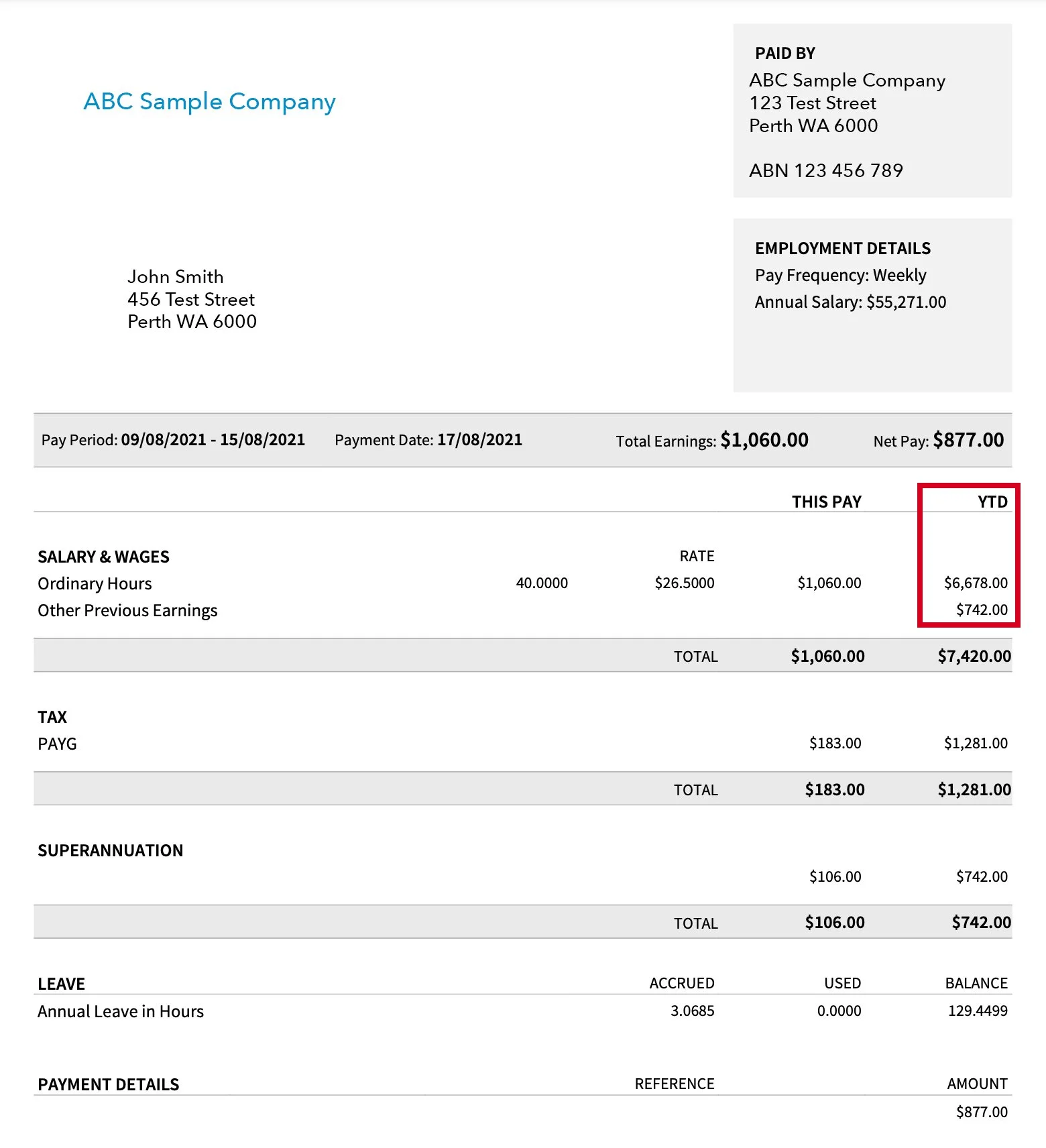

Payslips come in all shapes and forms, but the most important part to note is whether or not your payslip shows a “Year-to-date” (YTD) figure. This is how much you have earned since the start of the current financial year.

NOTE: If your payslip does not show a YTD figure, you must provide every payslip for the assessment period.

EXAMPLE:

Income Statement - ATO

Income Statements are available through your myGov login. They replace what used to be known as a PAYG Summary or Group Certificate.

The below steps should assist you in downloading a copy.

NOTE: In most cases it will be helpful to supply an Income Statement from each employer for the previous financial year.

Step 1 - go to the myGov website and log in.

STEP 2 - Under ‘Services’ select “Australia Taxation Office”. If you do not see this option, you will need to contact myGov support to link the service. We cannot assist with this step.

STEP 4 - Select either the ‘Current’ or ‘History’ tab to browse Employers and statements. Select the drop down arrow next to the relevant Employer to expand the statement.

STEP 3 - On the ATO website, click ‘Employment’ > ‘Income Statements’

STEP 5 - Scroll to the bottom of the summary and press the “Print-friendly version” button. You can then either print or save the statement (or take a screenshot if you are on a mobile device.)